Hip fractures are one of the most common and costly injuries treated in older adults across the United States. From emergency departments to orthopedic surgery units and post-acute rehab facilities, these cases touch almost every Part of the revenue cycle. When coding is off, even slightly, reimbursement suffers. Denials increase. Audits follow. Revenue leaks quietly.

Why Accurate Hip Fracture Coding Matters for Billing and Reimbursement

Accurate ICD-10 coding for hip fractures is not just about picking an S72 code. It is about understanding anatomy, fracture patterns, documentation language, encounter stages, payer rules, and how all of this ties directly into MS-DRGs, CPT selection, and payment levels.

This guide walks through hip fracture coding step by step, written from the perspective of an experienced RCM and medical billing professional who has seen where practices lose money—and how to fix it.

Understanding Hip Fractures for ICD-10 Coding

Clinically, the term “hip fracture” is broad. From a coding standpoint, that phrase alone is never enough.

Hip Fracture Anatomy Explained

Most hip fractures involve the proximal femur, which includes:

- The femoral head

- The femoral neck

- The intertrochanteric region

- The subtrochanteric region

In ICD-10-CM, traumatic hip fractures are primarily coded from category S72 – Fracture of femur. These codes are laterality-specific, require a seventh character, and often differ based on displacement, fracture pattern, and encounter type.

This level of detail matters because payers, especially Medicare, calculate reimbursement based on the specificity of diagnoses. A vague code can mean a lower-weighted DRG and thousands of dollars in unpaid charges.

Why “Hip Fracture” Is Never Enough for Coding

- Specificity

- DRG weighting

- Payer logic

Encounter Types and 7th Character Selection in Hip Fracture Coding

ICD-10 hip fracture codes require a 7th character to identify the stage of care. This character is not optional. It communicates whether the patient is receiving active treatment, follow-up care, or treatment for long-term complications. Incorrect encounter selection is a common cause of denials and audit findings.

Initial Encounter (7th Character “A”)

Used when the patient is receiving active treatment for the fracture. This includes:

- Emergency department care

- Surgical repair

- Initial orthopedic management

- Fracture reduction and stabilization

Example:

S72.012A – Displaced fracture of neck of left femur, initial encounter for closed fracture

Even if the patient is seen multiple times during the same hospital admission, the encounter is still considered “initial” as long as active treatment is ongoing.

Subsequent Encounter (7th Character “D”)

Used after active treatment has ended and the patient is receiving routine healing care, such as:

- Follow-up visits

- Cast changes

- Physical therapy during recovery

Example:

S72.012D – Displaced fracture of neck of left femur, subsequent encounter with routine healing

Sequela (7th Character “S”)

Used when treating late effects or complications of a healed fracture, including:

- Chronic pain

- Gait abnormalities

- Post-traumatic arthritis

Example:

S72.012S – Displaced fracture of neck of left femur, sequela

Selecting the wrong encounter type can result in medical necessity denials, incorrect DRG assignment, or post-payment recoupments during audits.

Key ICD-10 Codes for Hip Fractures (Category S72)

Before choosing a code, it helps to slow down and visualize the anatomy. Hip fractures are grouped by where the femur breaks and how severe the break is.

Unspecified Fracture of Head and Neck of Femur (S72.00-)

These codes are sometimes used when documentation lacks detail. From a billing standpoint, they should be avoided whenever possible.

For example:

- S72.001A – Unspecified fracture of head and neck of right femur, initial encounter for closed fracture

- S72.002A – Unspecified fracture of head and neck of left femur, initial encounter for closed fracture

While these codes are valid, they often trigger payer scrutiny. Medicare and commercial payers expect more specificity, especially when imaging reports are available. Using unspecified codes repeatedly can also raise audit risk.

Femoral Neck Fractures (S72.0-)

This is where most true “hip fractures” fall. Femoral neck fractures are prevalent in elderly patients after falls.

These fractures are further broken down by location:

- Subcapital (S72.01-) – Just below the femoral head

- Midcervical (S72.02-) – Middle portion of the femoral neck

- Base of neck (S72.03-) – Near the trochanteric region

- Displaced vs nondisplaced

Each subcategory also distinguishes between displaced and nondisplaced fractures.

A strong example of proper coding:

- S72.012A – Displaced fracture of neck of left femur, initial encounter for closed fracture

This level of specificity directly supports higher DRG assignment when paired with surgical intervention.

Intertrochanteric (Pertrochanteric) Fractures (S72.1-)

Intertrochanteric fractures occur between the greater and lesser trochanters and are common in high-impact falls.

ICD-10 further differentiates these fractures by displacement and involvement:

- S72.10- Unspecified pertrochanteric fracture

- S72.11- – Minimally displaced

- S72.12- – Moderately displaced

- S72.14- – Complete fracture with greater trochanter involvement

For example:

S72.142A – Displaced intertrochanteric fracture of right femur with greater trochanter involvement, initial encounter for closed fracture

From a reimbursement standpoint, displaced intertrochanteric fractures typically justify more complex surgical CPT codes and higher facility payments.

Subtrochanteric Fractures (S72.2-)

These fractures occur just below the lesser trochanter and often involve more complex fixation.

ICD-10 differentiates these by fracture pattern:

- S72.21- – Transverse

- S72.22- – Oblique

For example:

- S72.222A – Displaced oblique fracture of the shaft of the left femur, initial encounter for closed fracture

Coders must be careful here. Subtrochanteric fractures are managed as hip fractures but are coded differently than femoral neck or intertrochanteric fractures.

Pathologic and Osteoporotic Hip Fractures (Non-Traumatic Coding)

Not all hip fractures are traumatic.

If a fracture occurs due to osteoporosis or another underlying disease, traumatic S72 codes may be incorrect.

Osteoporosis-Related Hip Fractures (M80-)

M80.- – Osteoporosis with current pathological fracture

Pathologic Fractures Due to Other Diseases (M84.45-)

M84.45- Pathological fracture of the femur due to other disease

For instance:

- M84.452A – Pathological fracture, left femur, initial encounter

Using a traumatic fracture code for an osteoporotic fracture is a common compliance error and a red flag during audits.

Open Fractures and External Cause Coding Requirements

If the fracture is open, ICD-10 requires the Gustilo classification using the seventh character (e.g., B or C).

External cause codes are also expected:

- Fall type (W01- series)

- Place of occurrence

- Activity at time of injury (Y93-)

While these codes do not always affect payment, they are often required for claim completeness and injury reporting.

Common CPT Codes Used in Hip Fracture Treatment

Procedures vary depending on fracture type and severity:

- 27130 – Closed treatment without manipulation

- 27245 – Open treatment of intertrochanteric fracture with intramedullary implant

- 27236 – Open treatment of femoral neck fracture with prosthetic replacement (hemiarthroplasty)

Laterality modifiers such as LT and RT are critical, especially for commercial payers.

Inpatient vs Outpatient Hip Fracture Coding Considerations

Not all hip fracture encounters are inpatient admissions. Coding and billing requirements vary significantly depending on site of service.

Inpatient Hip Fracture Coding

- Diagnosis drives MS-DRG assignment

- Requires full specificity (laterality, displacement, encounter type)

- Reimbursement is bundled under DRG payment

Common inpatient scenarios include:

- Surgical repair (ORIF, arthroplasty)

- Medical management of unstable fractures

- Post-operative complications

Outpatient and Emergency Department Coding

- DRGs do not apply

- Medical necessity must be clearly documented

- Diagnosis selection supports CPT and E/M services

Common outpatient services include:

- Emergency department evaluation

- Diagnostic imaging

- Observation stays

- Post-discharge follow-up visits

Failure to distinguish between inpatient and outpatient coding rules can result in incorrect claim submission and reimbursement delays.

Documentation Requirements for Accurate Hip Fracture Coding

Strong coding starts with strong documentation. Many denials are not coding mistakes—they are documentation failures.

Physicians often document “hip fracture,” assuming everyone understands the details. Coders and billers know better.

To support the most accurate ICD-10 code, clinical notes should clearly state:

- Exact fracture location within the femur

- Displacement status

- Closed versus open fracture

- Laterality

- Traumatic versus pathologic cause

- Encounter stage (initial, subsequent, sequela)

Imaging reports are your best ally. X-ray and MRI findings often contain the specificity missing from progress notes.

Example of Strong Documentation

“Patient presents with right hip pain after a mechanical fall at home. X-ray shows a displaced transcervical fracture of the right femoral neck. Fracture is closed with no neurovascular compromise. The patient has known osteoporosis. Plan includes surgical fixation.”

This single paragraph supports laterality, displacement, cause, and the intent of treatment.

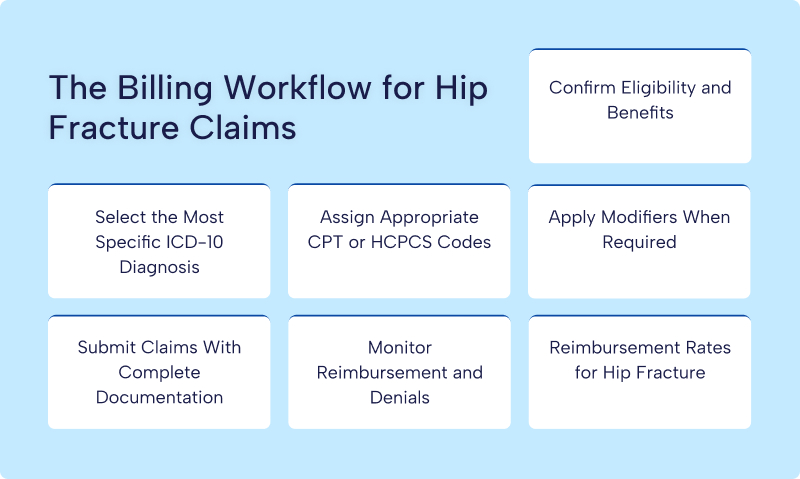

End-to-End Billing Workflow for Hip Fracture Claims

Hip fracture billing is not a routine, plug-and-play process. These claims traverse multiple systems, involve high reimbursement amounts, and attract close payer review. Because of that, every step in the workflow must be intentional. When one step breaks down, denials and payment delays usually follow.

Below is how an experienced billing team typically manages hip fracture claims from start to finish.

Eligibility and Benefits Verification

The workflow begins before a single line of code is entered. Eligibility verification sets the tone for the entire claim. For hip fracture patients, this step is critical because services often involve emergency care, inpatient admission, surgery, and post-acute rehabilitation.

Billing teams confirm the patient’s active coverage, payer type, and benefit structure. Medicare patients are checked for Part A inpatient benefits and any Medicare Advantage restrictions. Commercial plans are reviewed for prior authorization requirements, surgical coverage limits, and the facility and surgeon’s network status.

Skipping this step can be costly. A technically perfect claim may still be denied if the patient was not eligible on the date of service or if the provider was out-of-network.

Diagnosis Code Selection

Once eligibility is confirmed, diagnosis selection becomes the foundation of the claim. Hip fracture billing lives or dies by specificity.

The coder reviews the full medical record, not just the discharge summary. Emergency department notes, orthopedic consults, operative reports, and imaging findings are all used to determine the exact fracture type. The goal is to capture the most precise ICD-10 code from the S72 category, including laterality, displacement, and encounter type.

This step directly affects DRG assignment for inpatient cases and medical necessity for outpatient services. An unspecified fracture code can lower reimbursement, trigger payer edits, or flag the claim for audit.

CPT Assignment and Claim Preparation

After diagnosis coding is finalized, procedure coding follows. Hip fracture treatment often includes multiple billable services, not just the surgery itself.

Coders assign CPT codes based on the operative report and procedural details. The fracture type influences CPT selection. A femoral neck fracture treated with hemiarthroplasty will code differently than an intertrochanteric fracture repaired with an intramedullary nail.

For facility billing, inpatient claims are prepared on the UB-04 form, while professional services are submitted on the CMS-1500 form. Accuracy here ensures that diagnosis and procedure codes align logically, which payers expect.

Modifier Application

Modifiers are required for hip fracture billing. They clarify how, where, and on which side the procedure was performed.

Laterality modifiers such as LT and RT are commonly required for professional claims. Bilateral procedures may require modifier 50. In some cases, modifiers for staged procedures or multiple surgeons also apply.

Missing or incorrect modifiers can cause claim rejections or underpayment, even when the primary codes are correct.

Claim Submission and Documentation Review

Submission is more than hitting “send.” High-dollar hip fracture claims must be backed by strong documentation.

Operative notes, imaging reports, physician progress notes, and discharge summaries are reviewed to ensure consistency with the codes billed. Many payers request records upfront or shortly after submission, especially for inpatient surgical cases.

Clean claims go out the door only after the billing team confirms that documentation supports medical necessity, diagnosis specificity, and procedural complexity.

Reimbursement Tracking and Denial Management

The workflow does not end with submission. Hip fracture claims require active follow-up.

Payments are tracked against expected reimbursement based on DRG or contract rates. Underpayments are identified quickly. Denials are analyzed to determine the root cause, whether it is documentation, coding, eligibility, or payer policy.

Timely appeals are filed with corrected documentation when needed. Experienced teams also trend denial data to prevent repeat errors in future cases.

Reimbursement and DRG Impact for Hip Fracture Cases

When a patient is admitted for hip fracture surgery (e.g., femoral neck ORIF, arthroplasty), the hospital inpatient stay is grouped under DRGs that drive Medicare and commercial payment.

MS-DRG Reimbursement for Hip Fracture Surgery

- DRG 521

- DRG 522

These MS-DRG rates reflect national average reimbursement for these major inpatient cases in the recent 2025–2026 data:

MS-DRG 521 – Hip Replacement with Principal Diagnosis of Hip Fracture with MCC (Major Comorbidities/Complications)

· BCBS average: ~$35,462

· UHC average: ~$38,216

· Aetna average: ~$45,390

· Cigna average: ~$47,831

MS-DRG 522 – Hip Replacement with Principal Diagnosis of Hip Fracture without MCC

· BCBS average: ~$26,782

· UHC average: ~$28,638

· Aetna average: ~$34,095

· Cigna average: ~$34,711

Cases with severe comorbidities (e.g., heart failure, COPD, diabetes complications) receive a significantly higher payment band than less complex fractures. That’s why accurate coding of secondary diagnoses matters for reimbursement weight.

Other Fracture-Related DRGs

Even when a hip fracture doesn’t involve prosthetic replacement, there are related DRGs reflecting fracture management:

· Fractures of the femur with MCC (e.g., significant comorbidity): approx. $8,500+ Medicare national average.

· Fractures of the hip and pelvis without MCC (less complex hip fractures or pelvis involvement): approx. $4,600+ Medicare national average.

These are older Medicare national figures, but they align with real-world reimbursement ballparks seen in hospital payment data. Geographic variation is widespread—one study showed Medicare reimbursements for hip/pelvis fractures ranging from around $4,200 to $7,093 across regions.

Physician Reimbursement Under CPT (Professional Fees)

Medicare Physician Fee Schedule (PFS) and commercial payers reimburse surgeons and specialists for the actual fracture treatment procedure. While payer‐negotiated commercial rates vary widely, Medicare national averages give a baseline:

Hip fracture surgery CPT codes have historically been in the range of roughly $1,100–$1,300 for key procedures like:

- CPT 27130 – total hip arthroplasty

- CPT 27244/27245 – treatment of femur fracture

(Note: exact 2026 Medicare PFS national amounts are in flux due to updated CMS conversion factors; some recent reports suggest slight decreases year over year.)

Important context: CPT reimbursement here refers to the physician’s professional component, not the facility or hospital OPPS/APC payment.

Disclaimer: Rates vary by geography and payer contract.

How Secondary Diagnoses and Complications Affect Hip Fracture Reimbursement

Hip fracture cases rarely involve the fracture alone. Most elderly patients present with multiple chronic conditions that significantly impact treatment complexity, length of stay, and reimbursement.

Under Medicare MS-DRG logic, secondary diagnoses may qualify as:

- MCC (Major Complications or Comorbidities)

- CC (Complications or Comorbidities)

Capturing these diagnoses correctly can increase DRG weight and reimbursement by thousands of dollars.

Common MCCs and CCs Seen in Hip Fracture Patients

- Congestive heart failure (CHF)

- Chronic obstructive pulmonary disease (COPD)

- Acute kidney injury (AKI)

- Diabetes with complications

- Malnutrition

- Severe anemia

- Osteoporosis with current pathological fracture

Why Secondary Diagnosis Capture Matters

- Impacts DRG assignment (e.g., DRG 521 vs 522)

- Reflects patient acuity and resource utilization

- Supports medical necessity during audits

Clinical documentation improvement (CDI) queries play a critical role in ensuring these conditions are clearly documented, clinically supported, and coded accurately.

Common Hip Fracture Coding and Billing Mistakes (And How to Avoid Them)

Hip fractures are high-dollar, high-risk cases in revenue cycle management. As a result, even minor errors in coding, documentation, or claim submission can lead to delayed payments, denials, or audits. Below are the most frequent mistakes—and actionable ways to prevent them.

Using Unspecified or Generic Codes

Coding a hip fracture as “S72.00 – unspecified fracture of head and neck of femur” or simply documenting “hip fracture” without details.

Payers expect specificity in laterality, displacement, fracture type, and encounter type. Using unspecified codes can result in lower DRG payments, claim rejections, or audit flags.

How to avoid:

- Always review imaging reports and operative notes.

- Code the exact fracture site (subcapital, midcervical, base of neck, intertrochanteric, or subtrochanteric).

- Include laterality: Right (1), Left (2), or Bilateral (50 modifier for procedures).

- Use the 7th character for encounter type (A = initial, D = subsequent, S = sequela).

Misclassifying Traumatic vs Pathologic Fractures

Coding an osteoporotic fracture as a traumatic fracture (S72) or vice versa.

Using the wrong category can trigger denials, lower reimbursement, or compliance concerns during audits. Pathologic fractures have different reimbursement logic and often require secondary osteoporosis diagnosis codes.

How to avoid:

- Review patient history for osteoporosis, metastatic disease, or other underlying conditions.

- If fracture is due to osteoporosis, use M80.- codes.

- Cross-reference with DXA scan reports or documented history.

- Query the provider if the documentation is unclear.

Laterality and Modifier Errors

Omitting the LT/RT modifier or coding procedures without indicating which side was treated.

Payers can reject claims or underpay if laterality is missing. For bilateral procedures, failing to use modifier 50 can affect reimbursement.

How to avoid:

- Confirm laterality in imaging and operative notes.

- Ensure CPT modifiers match the surgical side.

- Check for bilateral procedures and apply the appropriate modifiers.

Inaccurate Fracture Details (Displacement, Open vs Closed)

Coding all hip fractures as “displaced” or “closed” without verifying or ignoring fracture classification.

Displacement status and open vs. closed classification directly influence CPT selection, DRG weight, and reimbursement.

How to avoid:

- Review operative and radiology reports for displacement, comminution, or open fracture.

- Match documentation to ICD-10 7th characters (A/B/C).

- Query the provider if radiology and clinical notes disagree.

Incomplete External Cause Coding

Omitting external cause codes (W, V, X, Y) for traumatic fractures.

While some payers do not require them for payment, most commercial insurers, workers’ comp, and auto insurance cases use them to justify medical necessity. Missing external cause codes can delay claims.

How to avoid:

- Always document the mechanism of injury (e.g., fall on the same level, fall from stairs).

- Use the corresponding external cause ICD-10 codes.

- Include activity codes (Y93.-) if applicable.

Missing Secondary Diagnoses

Only coding the hip fracture and ignoring conditions like diabetes, heart failure, COPD, or osteoporosis.

Comorbidities affect DRG assignment, payment, and risk adjustment. Missing secondary diagnoses can reduce reimbursement by thousands of dollars.

How to avoid:

- Review patient history and lab results for chronic conditions.

- Capture all comorbidities that impact treatment or recovery.

- Ensure they are supported by provider documentation.

Documentation Gaps

Using vague notes such as “hip pain after fall” or “proximal femur fracture” without specifics.

Coders cannot select the most specific ICD-10 code without detailed clinical information. Lack of specificity leads to underpayment or claim denials.

How to avoid:

- Encourage providers to include: exact fracture location, laterality, displacement, open/closed status, and cause.

- Reference imaging and operative reports in coding notes.

- Use CDI queries when documentation is unclear.

ICD-10 and CPT Mismatch

Billing a surgical procedure without matching the correct ICD-10 diagnosis.

Payers conduct “medical necessity checks” to confirm that the procedure aligns with the diagnosis. A misalignment often leads to denials or audits.

How to avoid:

- Ensure the diagnosis code supports the CPT code billed.

- For example, S72.142A (intertrochanteric fracture) aligns with CPT 27245 (open treatment with intramedullary implant).

- Document the clinical rationale for the procedure in the operative note.

Delayed Submission and Follow-Up

Submitting claims without verifying supporting documents or failing to follow up on denials.

Hip fracture claims are high-value; delayed submission or unresolved denials can significantly affect cash flow.

How to avoid:

- Verify all documentation before submission.

- Track claims in the AR system daily or weekly.

- Analyze denials for root causes and implement corrective action immediately.

Who This Guide Is For

- Medical coders

- Hospital billing teams

- Orthopedic practices

- Revenue cycle managers

- Healthcare administrators

Audit and Compliance Risks in Hip Fracture Billing

Hip fracture claims are high-value targets for payer audits due to their frequency, cost, and vulnerability to documentation and coding errors.

Common Audit Triggers

- Repeated use of unspecified fracture codes

- Incorrect traumatic vs pathologic fracture coding

- Missing documentation supporting displacement or laterality

- Inconsistent diagnosis and procedure alignment

- Missing secondary diagnoses affecting DRG assignment

High-Risk Audit Types

- Medicare RAC audits

- Commercial payer post-payment reviews

- Medical necessity audits

How to Reduce Audit Risk

- Enforce documentation specificity standards

- Align ICD-10 diagnosis codes with operative reports

- Use CDI queries proactively

- Perform internal coding audits on high-dollar fracture cases

Proactive compliance protects revenue and prevents costly recoupments long after claims are paid.

Final Thoughts: Protecting Revenue Through Accurate Hip Fracture Coding

Hip fracture coding sits at the intersection of clinical care, compliance, and revenue integrity. Small documentation gaps can snowball into major financial losses.

When coders, billers, and providers work together, hip fracture claims become cleaner, faster, and far more profitable. Precision is not optional here. It is the difference between getting paid correctly and fighting denials long after the patient has moved on.

Accurate coding protects revenue, supports compliance, and ultimately reflects the quality of care delivered.

Need Expert Help With Hip Fracture Coding & Reimbursement?

Hip fracture cases are complex, high-value, and audit-sensitive. If your organization is struggling with denials, underpayments, or documentation gaps, RCM Xperts can help.

Our experienced billing and coding specialists work directly with hospitals, orthopedic practices, and revenue cycle teams to ensure:

- Accurate ICD-10 and CPT coding

- Proper DRG assignment and secondary diagnosis capture

- Reduced denials and audit risk

- Faster, more predictable reimbursement

Talk to RCM Xperts About Your Hip Fracture Billing Challenges